Suffering Scotland: Left Behind by the Rest of the UK

Press release: 26th March 2014

Home.co.uk Investigates the Stagnating Scottish Property Market

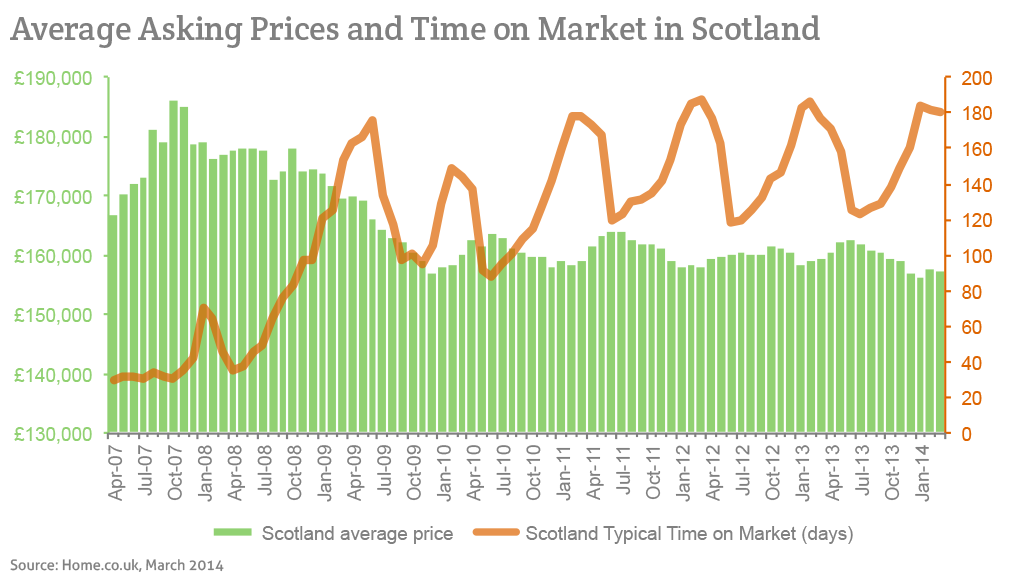

The average asking price for a Scottish home is now 15.5% lower than the boom-time peak registered in October 2007. By contrast, the average asking price for a home in England and Wales has increased by 4.3% over the same period. In this report, we consider why the Scottish property market has made little progress along the road to recovery.

Scottish house prices soared during the last property boom. Between October 2005 and the October 2007 peak, the mix-adjusted average rose by 35.2%. During the same period, home asking prices in England and Wales rose by only 5.1%, as most regional markets (especially the South) had already overheated at this stage in the boom-bust cycle. Hence, as is often the case, the last to rise has the furthest to fall.

By October 2009, Scottish property prices had fallen by 13.7% and it is arguable that they would have fallen much further had the Bank of England not set ultra-low interest rates earlier the same year. On the upside, lower SVRs meant fewer defaults and fewer repossessions, but on the downside, home prices remained artificially high and market stagnation took hold.

If we look at the Time on Market trend for the last seven years, we can see that having had the lowest Typical Time on Market in the UK (even lower than London) during the boom, properties soon piled up when the financial crisis hit and the market stagnated. Overall, despite the Help to Buy scheme, Scottish Time on Market figures remain among the worst in the UK, showing that more normal market momentum has yet to return to most of the country.

However, there are always local exceptions. One location in particular where the market is functioning very well and properties are selling quickly is Aberdeen. The property market in the university city achieved a spectacular turnaround in 2013. Buyer demand soared, clearing the backlog of properties and, quite remarkably, the 'oil and gas capital of Scotland' now has some of the lowest time to sell figures in the UK. Consequently, prices are rising in Aberdeen, and the city may be regarded as a shining example of how quickly a property market can recover.

Doug Shephard, director at Home.co.uk, commented:

"Unlike Aberdeen, most of Scotland has a long way to go before the property market finds its feet again. Considering the much improved availability of cheap mortgages and government help to get on the housing ladder, Scottish properties are spending far too long on the market.

The Scottish market has stagnated because it is clogged up with overpriced properties hanging around for six months or longer. Sensibly priced properties are still selling in a reasonable time frame but, unfortunately, they are few and far between. While interest rates remain so low and mortgage payments can be met, sellers will not have a sense of urgency and pricing will remain overly optimistic. After all, if it won't sell, the vendor can always turn to the booming rental sector."

Source: Home.co.uk Asking Price Index

Notes for Editors

Over the last 29 years, Home.co.uk has become established as a dynamic, innovative and ethical service. By providing the UK's most comprehensive Property Search and Estate Agents directory coupled with detailed House Price analysis, Home.co.uk delivers the real power of the Internet to inform and empower estate agents, homebuyers, renters, landlords and sellers in across the UK.

Contact Details

Email:

Phone: 0845 373 3580

Back to Home.co.uk Press