House Price Gains vs. the Value of Money

Press release: 1st May 2014

Home.co.uk Investigates if House Prices Have Kept Up with Inflation

Whilst the average price of a home across England and Wales continues to rise, we consider whether or not prices have kept abreast of inflation over the last six years. Last month, the average asking price for a home leapt a further 1.3%, bringing the annual rise to 8.4% and a situation whereby prices are now rising faster than at any time during the last property boom. However, only when we take into account the rate of inflation do we get a real idea of how property prices are performing relative to the cost of other goods and services. New research from property website home.co.uk looks to address this and uncover what has really happened to housing prices since the financial crisis hit.

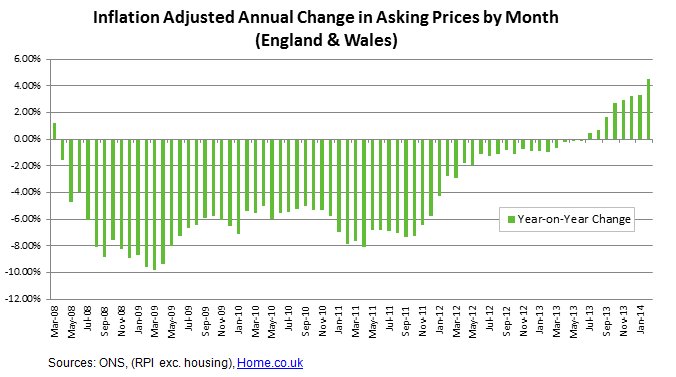

Between March 2008 and June 2013, home prices across England and Wales have underperformed with respect to inflation. This 5-year lull (crash followed by stagnation) caused great pain for the majority of homeowners across the country, the banks and the economy at large. It was not until July 2013 that the mix-adjusted average home price in England and Wales recorded a rise ahead of inflation (+0.5%). The market since then has truly turned the corner and real capital value is being restored in many, but not all, regions. Viewed from this keen perspective, we have only witnessed eight months of real price growth following 64 months of actual price falls in real terms. This firmly suggests that the current price cycle has a long way to go.

Back in March 2008, home prices were falling at an annualised 9.8% in real terms when corrected for the effects of inflation (then 2.9%). According to official ONS figures, since March 2008, we have witnessed 27.8% of monetary inflation (RPI inflation exc. housing) which impacts significantly on real house value appreciation.

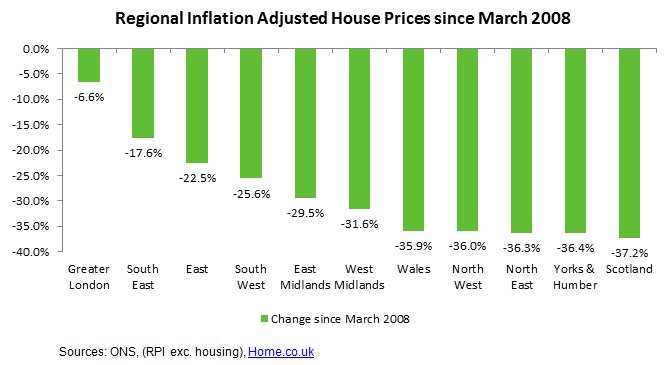

In recent months, property has demonstrated that it is again becoming a real store of capital value and yet, in the longer term, the picture remains significantly different. Even the booming London market is unable to escape the reality of inflationary pressures, with an inflation adjusted price fall of almost 7%. Since early 2008, the northern regions of England and Scotland have suffered the most, with all of these areas recording adjusted price falls in excess of 35%.

Doug Shephard, director at Home.co.uk, commented:

"Home buyers and house price analysts alike often neglect the effects of inflation when assessing property price trends over time. However, it is vital that we take into account monetary depreciation if we are to compare current prices with historic figures accurately.

The current boom looks much less significant when we correct the current prices for the effects of inflation. If home prices had kept pace with inflation over the last seven years, the average home would cost around £290,000. As of today, it only attracts an asking price of £256,976.

The reality is that, when adjusted for inflation, average asking prices across England and Wales have fallen by 25% since March 2008. Consequently, we strongly believe that more effort should be taken to correct published house price figures for the effects of inflation to improve accuracy and to create a more robust historic data set on which to base decisions. Taken at face value, nominal house price rises may look great but, if they haven't kept up with the price of other goods and services, then the rise is purely illusionary."

Source: Home.co.uk Asking Price Index

Notes for Editors

Over the last 29 years, Home.co.uk has become established as a dynamic, innovative and ethical service. By providing the UK's most comprehensive Property Search and Estate Agents directory coupled with detailed House Price analysis, Home.co.uk delivers the real power of the Internet to inform and empower estate agents, homebuyers, renters, landlords and sellers in across the UK.

Contact Details

Email:

Phone: 0845 373 3580

Back to Home.co.uk Press