Press release: 19th August 2013

Home.co.uk reveals the growing disparity across Britain's regional property markets

The relative value of homes across the UK has changed radically over the last five years. The strong property market recovery, post-crisis, evident in London and the South East has not been mirrored in other regions. In stark contrast to the prosperous South, house prices across the North are still below their 2008 levels and markets remain lacklustre. Moreover, the gap in home values is widening and this trend is effectively further centralising the bulk of the UK's property wealth in London and the South East.

A huge surge in London property prices is well underway and, as yet, shows no signs of slowing down. The average asking price for a property within Greater London now stands at £389,025, a rise of 6.8% in the last six months alone. Such growth and further relentless demand all point towards an overheating market. Despite this, the UK government and Bank of England are continuing their support for mortgage lending and loose monetary policies.

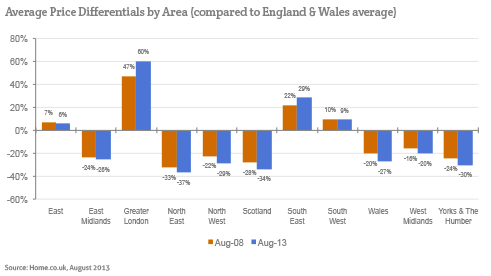

In August 2013, an average London property is priced 60% higher than the average for England & Wales. The South East, South West and East Anglia also record above average prices whilst the rest of the country, Wales and Scotland fall below the average of £242,541. Whilst we have reported on the regional variations and North-South divide before, it is important to track how the situation has evolved over the past five years.

Property prices in London are higher than ever before and the market in the capital bears little resemblance to the rest of the country. Property in the surrounding South East has performed reasonably well, yet the price differential is still dwarfed by London's super-premium pricing. Given the pressure on prices in the North and Scotland, the gap with these regions has actually widened over the past five years. For example, an average property in the North East now costs £153,160 which is 6% lower than in 2008.

This, in turn, has widened the average price differential from 33% to 37%. The situation in Wales, the Midlands, the North and Scotland is the same: average property price differential has actually grown in the past five years.

Doug Shephard, director at Home.co.uk, commented:

"The London property market is a law unto itself. Relentless demand from both domestic and foreign buyers is creating a market that is seemingly isolated from the grim economic challenges that face the rest of the country. Slower sales and slower price recovery (or even deflation) in other areas serve only to highlight the unique performance of the capital's property market.

The North-South divide has evolved to the point where financial policy makers need to treat London differently to the rest of the country. The London property market clearly needs no further stimulus; it's running too hot already. Only time will tell if the market will overheat and naturally realign prices in the process. However, the concern is that, if the capital's property bubble does burst, it may well shake the confidence of the wider market (and financial sector) and make no difference to the price differential. Given the government policies and a wealth of buyers favouring the capital, the property gap between London and the rest of the country is likely to grow further in the immediate future."

Sources: Home.co.uk Asking Price Index

Notes for Editors

Over the last 28 years, Home.co.uk has become established as a dynamic, innovative and ethical service. By providing the UK's most comprehensive Property Search and Estate Agents directory coupled with detailed House Price analysis, Home.co.uk delivers the real power of the Internet to inform and empower estate agents, homebuyers, renters, landlords and sellers in across the UK.

Contact Details

Email:

Phone: 0845 373 3580

Back to Home.co.uk Press