Press release: 23rd January 2014

Home.co.uk Assesses the Rise of the UK's Private Rental Sector

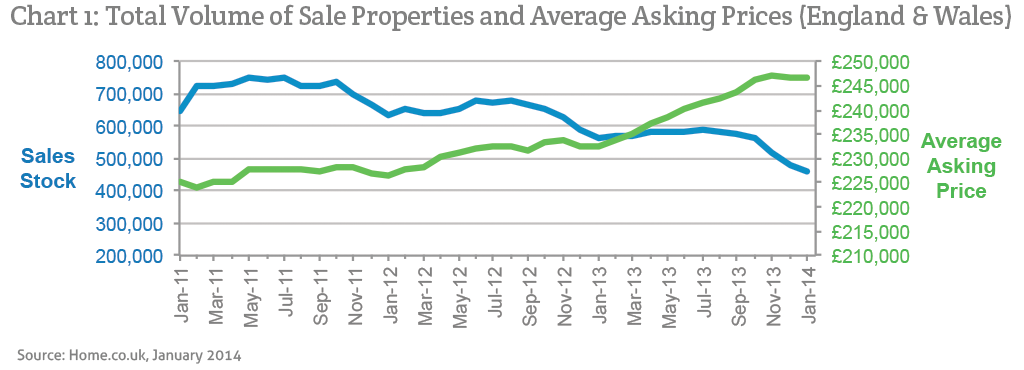

Over the past three years, the relationship between sales stock and house prices has been inversely correlated (the classical economics of falling supply and increasing demand), creating intense misery for home hunters, especially those on lower incomes like first-time buyers. Since the beginning of 2011, the total volume of properties for sale has fallen by 29% and, subsequently, average asking prices have risen by 9.5%.

Government data indicates that there are approximately 22.8 million dwellings in the UK, and that the net annual growth in housing stock in recent years has been as little as 165,000 1 per annum. Without doubt, population growth and the rise of one-person households and second homes are outpacing the supply of newly constructed property. Moreover, the crisis is more than just geodemographic trends (e.g. immigration, job seekers moving to London and the SE). Perhaps the main contributor to the stock shortage in the UK's resale market is the transformation of the tenure of recent decades.

The Right to Buy scheme, passed in the Housing Act 1980, kick-started a transformation of tenure in the UK that is still evolving today. Even in the last 20 years, the subsequent swing towards private rented sector to the detriment of both public sector housing and the first-time buyer is clear. In 1991, 23% of stock was public sector dwellings and just 12% of homes were rented privately. Jump forward to 2011, and the private rented sector has grown to 27% whilst public housing stock accounts for just 8% of dwellings.

With councils unable to replace the homes they sold, fewer homes being built by the private construction sector, cuts in central government funding for housing associations, a rise in single occupancy households2 and the subsequent huge growth in the private rented sector, a substantial squeeze on the resale market was inevitable: a recipe for the perfect storm.

At the start of the credit crisis in 2008, the number of first-time buyers fell sharply to 192,000, a drop of 46.6 per cent on the previous year. By 2010, the figure had recovered slightly and stood at 200,000. This figure is still down by more than two thirds from the historic peak of 613,000 seen in 1986. Non-first time buyer figures showed a similar fall followed by a slight recovery. In 2008, there were 334,000 such buyers, a fall of more than half (51.0 per cent) from the previous year, and decline of 61.3 per cent from the historic peak of 887,000 seen in 2004. By 2010, the figure stood at 343,000. Extract from Measuring National Well-being - Households and Families, 2012 by Ian Macrory: Office for National Statistics

Doug Shephard, director at Home.co.uk, commented:

"Once the UK's public investment in housing had been largely privatised, the writing was on the wall. Landlords, almost always more creditworthy than first-time buyers, effectively remove the stock from the resale market for many years and, at the same time, bloat the private rental market. Despite job insecurity and the unforgiving reality of finding a suitable property for lifestyle and budget, the aspiration to own a home remains widely held. However, the modern day reality has clearly been made a lot more difficult by the financial crisis and the rise of the private rental sector."

Sources: Home.co.uk Asking Price Index

1 Gov.uk Live Tables: Dwelling stock by tenure.

2 According to National Well-being - Households and Families, 2012 by Ian Macrory: Office for National Statistics: Single person occupancy in 45 to 64-year olds has shown the strongest growth since 2001, with a 36.2 per cent increase to 2.4 million.

Notes for Editors

Over the last 28 years, Home.co.uk has become established as a dynamic, innovative and ethical service. By providing the UK's most comprehensive Property Search and Estate Agents directory coupled with detailed House Price analysis, Home.co.uk delivers the real power of the Internet to inform and empower estate agents, homebuyers, renters, landlords and sellers in across the UK.

Contact Details

Email:

Phone: 0845 373 3580

Back to Home.co.uk Press