Press release: 15th December 2017

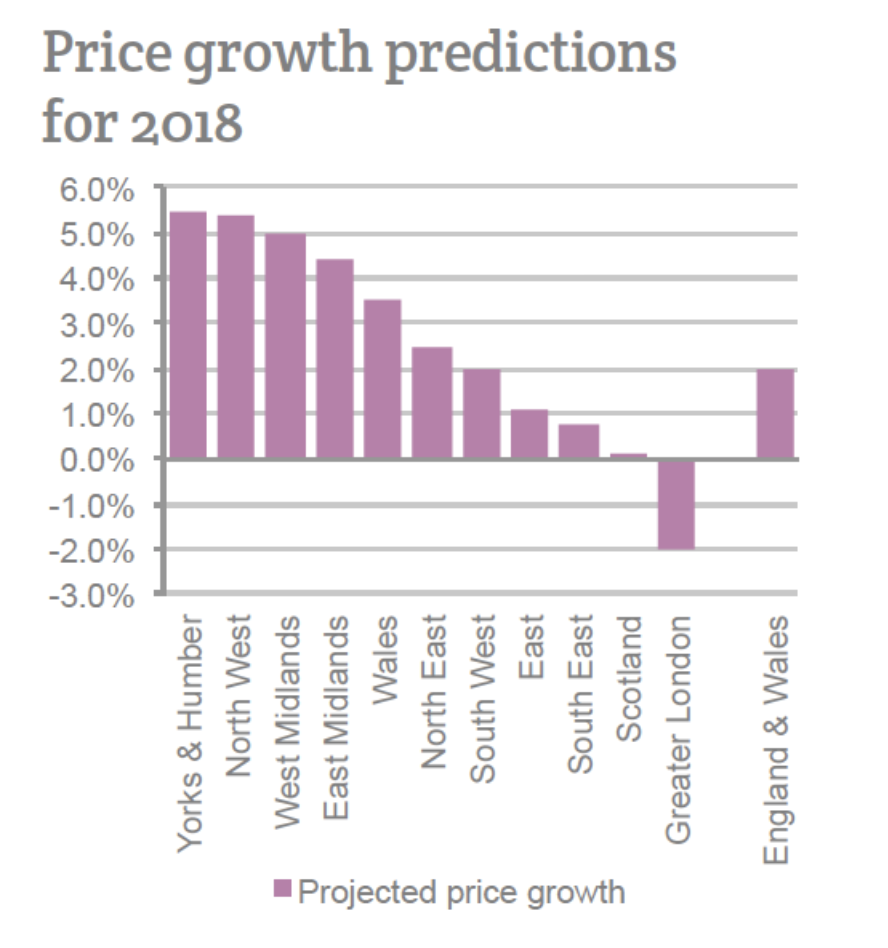

A pullback in the Buy-to-Let market is threatening to reduce prices further in London and parts of the South East during 2018, while Yorkshire and the North West are being lined up as the next boom areas, according to latest housing market predictions from property website Home.co.uk.

The tail end of 2017 has already seen the supply of homes rocket across the UK. At the same time the number of rental properties on the market has shrunk, suggesting that increasing pressures in the Buy-to-Let market is causing swathes of landlords to cash in on their investments.

Between November 2017 and November 2016 the number of new sales instructions jumped by 11% across the UK, while at the same time the supply of rental properties fell by 16%.

This increase in supply is set to continue throughout 2018, says Home.co.uk, which will put considerable downward pressure on house prices next year.

Prices in London and the South East will be among the hardest hit as the high cost of property means rental yields are less of a hook to keep landlords in the market.

The capital and the South East are also particularly vulnerable as they have already suffered price falls during 2017.

Prices in Greater London slid for a fifth consecutive month in December, by 0.3% compared to November, pushing the year-on-year change to -1.0%. In the South East prices fell by -1.4% between November and December and the annual change is now 2.3%, less than the England and Wales average of 2.6%.

In contrast, 2018 looks far brighter for sellers in Yorkshire and the North West in particular. These are two areas that Home.co.uk anticipates will become the leading regions for price growth towards the end of next year.

Annual price hikes of 4.7% for the North West and 4.4% for Yorkshire during 2017 are the biggest in these regions for many years and further rises are expected next year.

A key reason is that private rental landlords in these areas enjoy some of the highest yields in the country, which means property is in demand from both Buy-to-Let landlords coming into the market and existing landlords keen to hang onto their investments.

Prices in the West Midlands are also set to continue to rise due to interest from buyers looking for an investment. Asking prices in this region rocketed by 6% over 2017 with further increases likely into next year.

The private rented sector now accounts for around a fifth of residential property ownership, which makes it one of the most significant drivers of change in the property market.

As well as low rental yields in parts of the country, landlords are also facing further regulatory and financial pressures.

In September, the government announced that all landlords will have to become members of an ombudsman scheme, to deal with issues such as potential disputes with tenants.

Also, in April this year, the way Buy-to-Let investments are taxed changed, with landlords unable to offset all their mortgage interest against their profits. Within three years none of this interest will be tax deductible.

This follows changes brought in during 2016, including an additional stamp duty surcharge for private landlords and the loss of the 10% wear and tear allowance for those renting out fully furnished properties.

Home.co.uk director Doug Shephard said: "Any sort of Buy-to-Let exit will tip the market to the downside and the UK government should be monitoring the situation very carefully. Why? Because such a risk to the housing market would imperil the banks (again) and the wider national economic interest, especially post-Brexit.

"If landlords are forced to sell up, all property prices will be driven down, leaving the first-time home owner in negative equity and mortgage liquidity hard to find for the first-time buyer. Surely not something the government would wish upon the housing market in 2018."

Source: Home.co.uk Asking Price Index

Notes for Editors

Over the last 28 years, Home.co.uk has become established as a dynamic, innovative and ethical service. By providing the UK's most comprehensive Property Search and Estate Agents directory coupled with detailed House Price analysis, Home.co.uk delivers the real power of the Internet to inform and empower estate agents, homebuyers, renters, landlords and sellers in across the UK.

Contact Details

Email:

Phone: 0845 373 3580

Back to Home.co.uk Press